How to Participate

How Can I Participate?

Donations can be made in the form of a long term pledge, annual gifts of cash or appreciated securities, or potentially charitable gifting through qualified retirement accounts.

How Can I Make a Long Term Pledge?

You can arrange an appropriate sized gift/pledge by contacting us.

-

There are various levels of gifting available - both anonymously and with naming rights

What About Annual Giving?

As part of year-end tax planning, please consider a gift to benefit St Paul R.C. Church through the Damascus Fund

-

There are various options to explore for those who would like to distribute a gift over an extended period of time for planning purposes

-

Subject to applicable tax regulations and individual circumstances

-

-

Contact us to inquire

Why Would I Use Retirement Funds for Gifting?

As part of an Estate Planning strategy or to reduce Income Tax liability associated with the Required Minimum Distribution, many families benefit from Qualified Charitable Distributions to meet their needs.

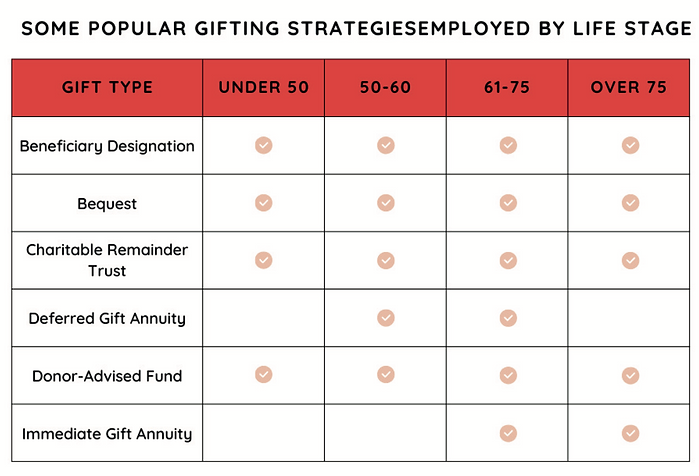

Some Popular Gifting Strategies Employed by Life Stage:

Matching Gifts

If your company has a matching gift program, be sure to include an appropriate form with your contribution

How Does Planned Giving Help Me?

According to the current IRS regulations, implementing a strategic gifting plan could potentially reduce the net-tax liability for both your individual tax return and the overall Estate.

How to Support Our Mission

To make a donation or if you have any questions, contact us.